The Government of Pakistan, in collaboration with the State Bank of Pakistan, the Ministry of Finance, and 1LINK as a strategic partner, proudly introduces the Sohni Dharti Remittance Program (SDRP) — a first-of-its-kind remittance loyalty program. SDRP is a point-based loyalty program designed exclusively for non-resident Pakistanis (NRPs) who send remittances to their families in Pakistan through official banking channels or exchange companies. Below are the key features of SDRP program:

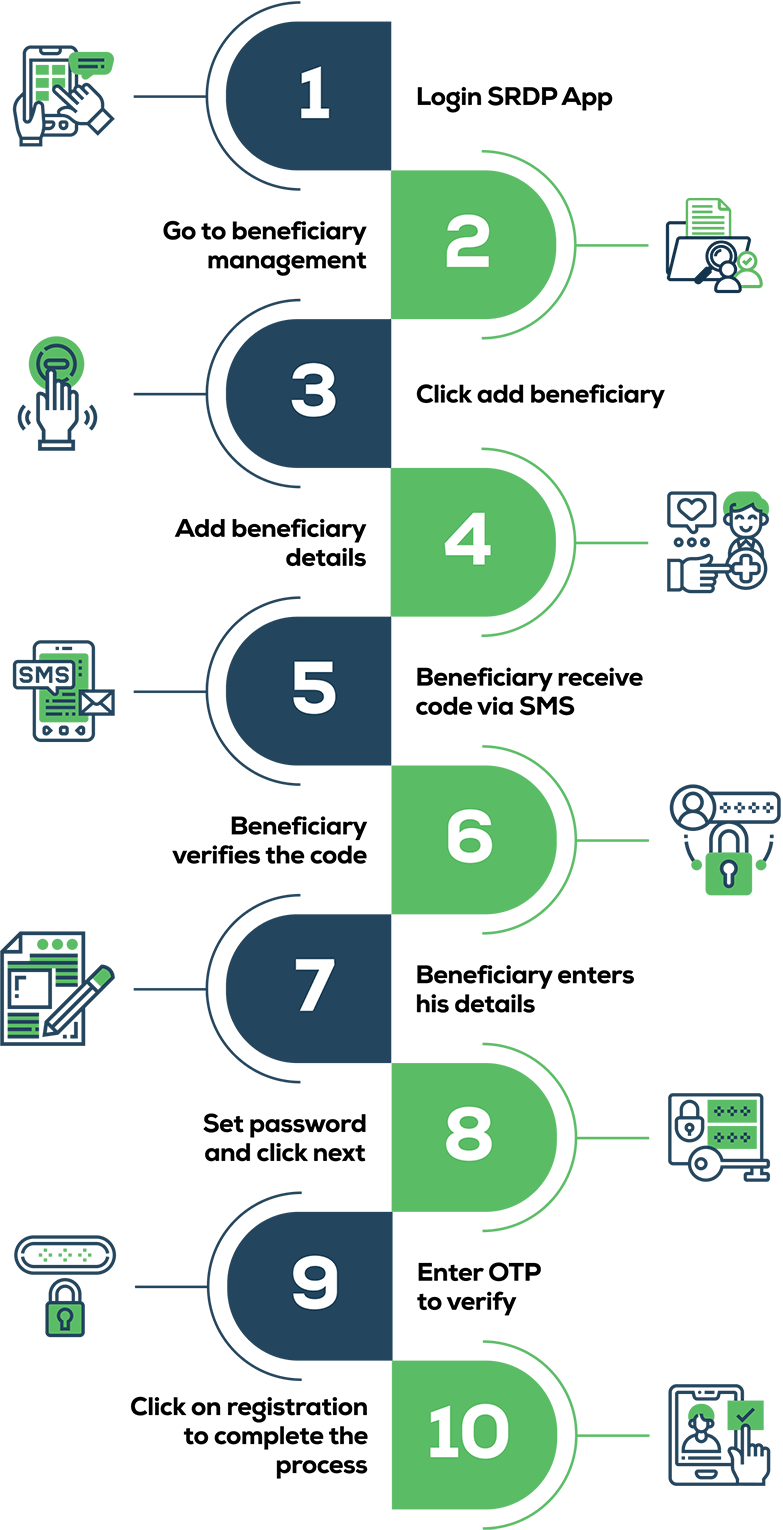

We are making your remittance journey simpler, safer, and stronger than ever. Managing beneficiaries is now smarter and more secure and you can enjoy updated points redemption and transfer options across passports, PIA tickets, State Life, FBR services, and more. The beneficiary Management functionality is available on SDRP App from September 29, 2025.

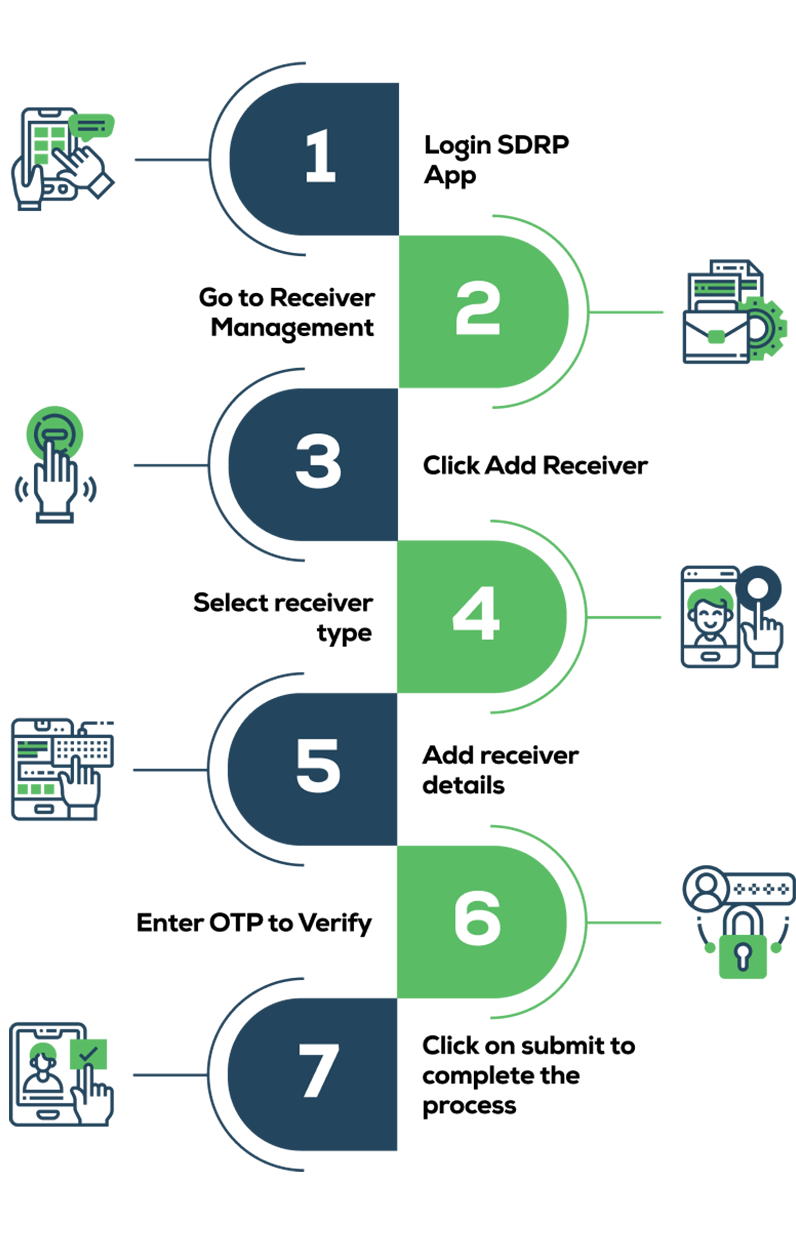

Sohni Dharti Remittance Program. An incentive program encouraging Non-Resident Pakistanis to use formal remittance channels to send their money and earn reward points to avail exciting privileges exclusively for remittance senders and receivers. Register in these easy steps and earn reward points instantly!

Sohni Dharti Remittance Program is an initiative to incentivize Non-Resident Pakistanis who send home remittances to Pakistan through official remittance channels. Registered users are eligible to earn reward points on remittances and avail exciting privileges exclusively for remittance senders and receivers.

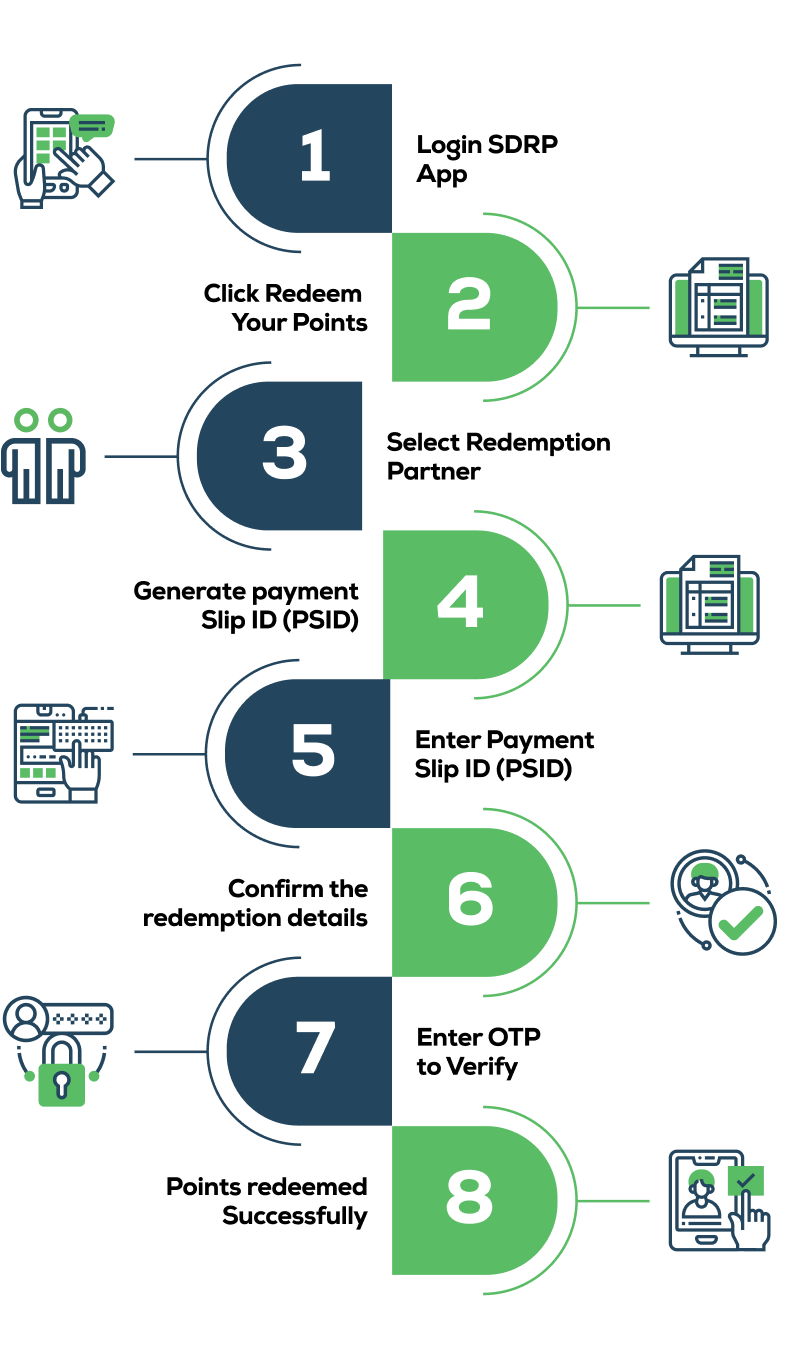

How to Redeem your loyalty points For Utility Stores Corporation.

8 Simple Steps to Follow:

You can also browse the topics below to find what you are looking for.

Yes, there are three types of redemption limits in Sohni Dharti Remittance Program.

| Description | Limit (PKR) |

|---|---|

| Customer profile / day limit | – |

| Customer profile / month limit | 300,000 |

| S.No | PSE | Per Transaction / Profile Limit (PKR) | Per Month Limit (PKR) |

|---|---|---|---|

| 1 | BEOE | 2,500 | 7,500 |

| 2 | OPF | 20,000 | 60,000 |

| 3 | PIA | 300,000 | 300,000 |

| 4 | Passport | 20,000 | 50,000 |

| 5 | FBR | 200,000 | 200,000 |

| 6 | State Life | 200,000 | 200,000 |

| S.No | PSE | Velocity per Customer / Day Limit | Velocity per Customer / Month Limit |

|---|---|---|---|

| 1 | BEOE | ||

| 2 | OPF | ||

| 3 | PIA | ||

| 4 | Passport | 1 | 3 |

| 5 | FBR | ||

| 6 | State Life |

Note: All limits are simultaneously applicable on each customer profile.

| S.No | PSE | Current Services |

|---|---|---|

| 1 | FBR |

|

| 2 | Passport |

|

| 3 | State Life Insurance |

|

| 4 | PIA |

|

| 5 | OPF |

|

| 6 | BE & OE |

|